Tag Archives: google pay

Aligning the user experience across surfaces for Google Pay

During the last months we've been working hard to align the Google Pay user experience across Web and Android. We are committed to advancing all Google Pay surfaces progressively, and creating a more cohesive experience for your users. In addition, the Google Pay sheets for Android and Chrome on Android now use the latest Material 3 design system with Web to follow in early 2024.

UX improvements on Android

Aligning the bottom sheets on Android and Chrome for Android (Mobile Web) led to a ~2.5% increase in conversion rate and a ~39% reduction in errors for users using Google Pay with Chrome on Android[1].

|

| Figure 1: The identical Google Pay bottom sheets for Android (left) and Chrome on Android (right) |

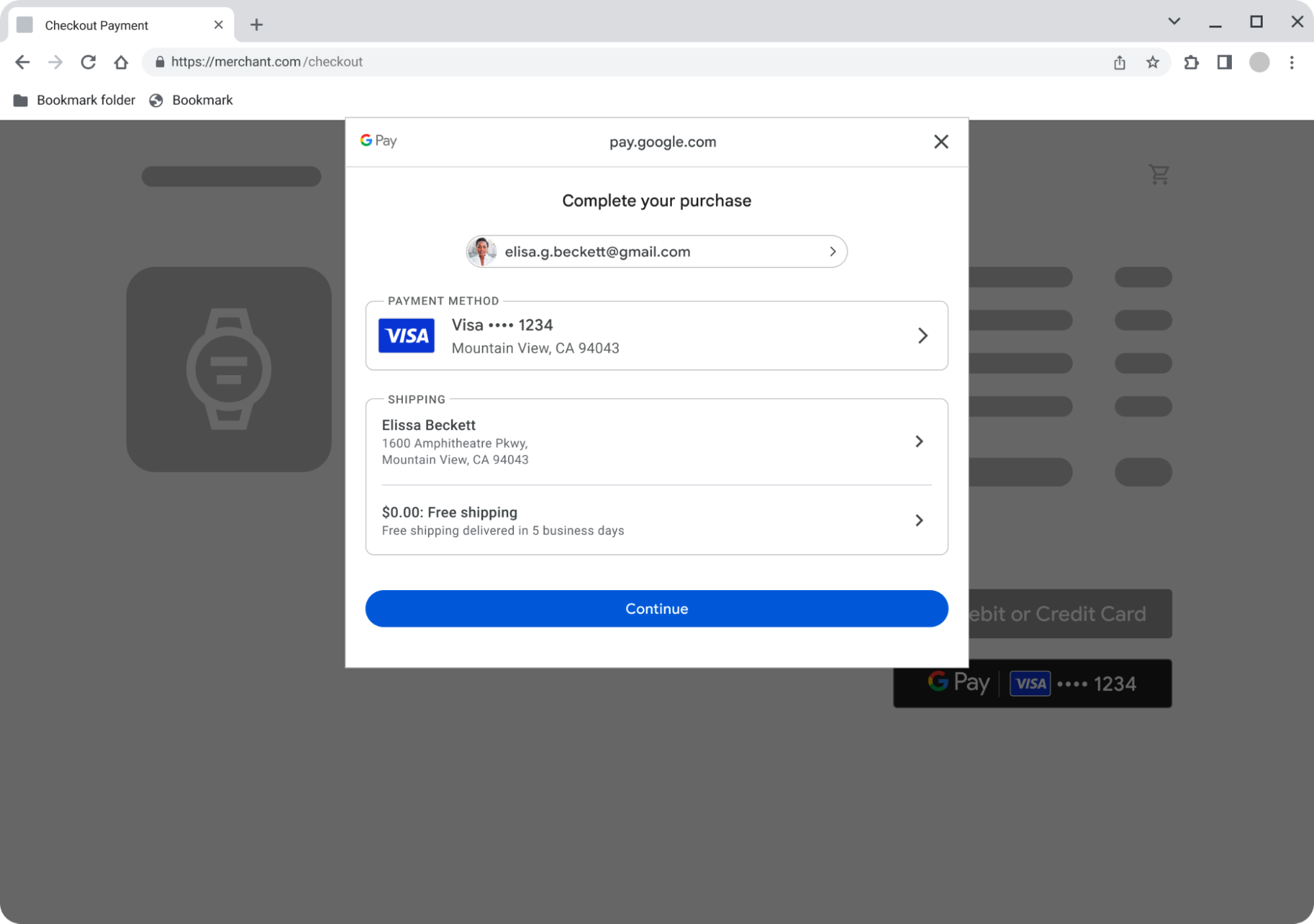

A completely revamped Google Pay sheet on the Web

On the web we aligned the user experience to be the same as on Android. Additionally we gave the Payment Handler window a more minimalistic look. With these changes we are seeing a conversion rate increase of ~9%.[1]

|

| Figure 2: Google Pay displayed inside the new minimalistic Payment Handler window |

No changes required!

Whether you are a merchant integrating Google Pay on your own or through a PSP, you don’t need to make any changes. We've already rolled out these changes to most of our users. This means that your users are likely already benefiting from the new experience or will very soon. For certain features, for example dynamic price updates, Google Pay will temporarily show the previous user experience. We are actively working on migrating all features to benefit from the new updated design.

Getting started with Google Pay

Not yet using Google Pay? Take a look at the documentation to start integrating Google Pay today. Learn more about the integration by taking a look at our sample application for Android on GitHub or use one of our button components for your web integration. When you are ready, head over to the Google Pay & Wallet console and submit your integration for production access.

Follow @GooglePayDevs on X (formerly Twitter) for future updates. If you have questions, tag @GooglePayDevs and include #AskGooglePayDevs in your tweets.

[1] internal Google study

Commute around the world with Google Wallet

From London to San Francisco to more than 500 cities around the world, here are the ways we are making digital payments a reality for commuters.

From London to San Francisco to more than 500 cities around the world, here are the ways we are making digital payments a reality for commuters.

Source: The Official Google Blog

4 ways to easily check out on Chrome

Ahead of the holiday shopping season, it’s getting even easier to check out on Chrome.

Ahead of the holiday shopping season, it’s getting even easier to check out on Chrome.

Source: The Official Google Blog

What’s new in Google Wallet

During Google I/O 2023, and in our recent blog post, we shared some new pass types and features we’re adding to Google Wallet and discussed how you can use them to build and protect your passes more easily, and enhance the experience for your customers.

Read on for a summary of what we covered during the event, or check out the recording of our session on YouTube: What's new in Google Pay and Google Wallet.

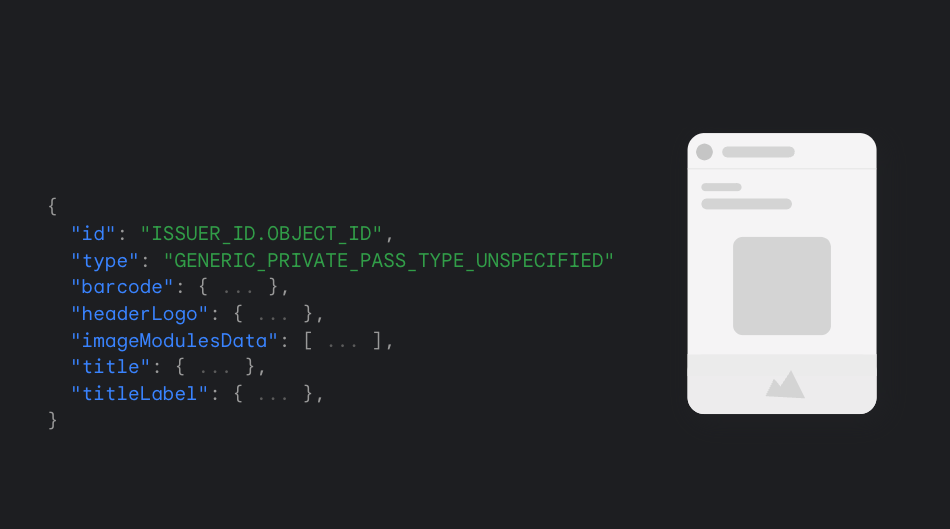

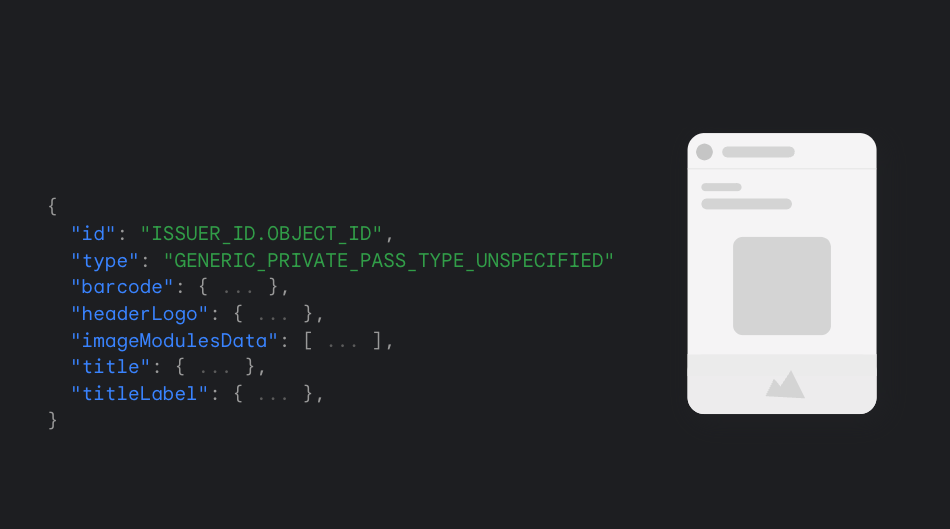

Secure pass information with private passes

We’re glad to expand Generic Passes, adding support for sensitive data with the new generic private pass API. Generic private passes on Google Wallet are one more way we’re protecting users’ information, keeping their sensitive digital items safe. These types of passes require you to verify it’s you to view private passes. To do that, they can use the fingerprint sensor, a passcode, or other authentication methods. This is helpful when you create a pass with sensitive information, for example in the healthcare industry.

The Google Wallet Developer Documentation contains detailed steps to help you add a private pass to Google Wallet.

|

| Figure 1: The definition for a private pass in JSON format. |

Enable fast pass development with Demo Mode

With Demo mode, you can go to the Google Pay & Wallet Console, sign up for API access, and integrate it with your code immediately after following the prerequisites available in the Google Wallet developer documentation.

When you sign up for a Google Wallet Issuer account for the first time, your account is automatically in Demo Mode. Demo mode includes the same features and functionality as publishing mode. To better differentiate between the demo and publish environments, passes created by issuers in Demo Mode contain visual elements to indicate their test nature. This distinction is removed when the issuer is approved to operate in publishing mode.

When you’re done with your tests and you’re ready to start issuing passes to your users, complete your business information and request publishing access from the Wallet API section in the console. Our console team will get in touch via email with additional instructions.

|

| Figure 2: Demo Mode in Google Pay & Wallet console. |

Enhance security with rotating barcodes and Account-restricted passes

We are increasing the security of your passes with the introduction of a new API to rotate barcodes. With rotating barcodes you can pre-create a batch of barcodes and sync them with Google Wallet. The barcodes you create will rotate at a predefined interval and will be shown and updated in your user’s wallet. Rotating barcodes enable a range of use cases where issuers need to protect their passes, such as long duration transit tickets, events tickets, and more.

We’ve also announced Account Restricted passes, a new feature that lets issuers associate some pass objects with Google accounts. To use this feature, simply include the user’s email address in the pass object when you issue the pass. This triggers an additional check when a user attempts to add the pass to Google Wallet, which only succeeds if the email address specified in the pass matches the account of the currently logged-in user. Account Restricted passes let you protect your passes from theft, reselling, transfer or other restricted uses.

Design your passes using the pass builder

Making your passes consistent with your brand and design guidelines is a process that requires becoming acquainted with the Google Wallet API. During last year’s Google I/O, we introduced a dynamic template that accepts configuration to generate an approximate preview of your pass.

This year, we introduced the new generation of this tool, and graduate it into a fully functional pass builder. You can now configure and style your passes using a real-time preview to help you understand how passes are styled, and connect each visual element with their respective property in the API. The new pass builder also generates classes and objects in JSON format that you can use to make calls directly against the API, making it easier to configure your passes and removing the visual uncertainty of working with text-based configuration to style your passes. The new pass builder is available today for generic passes, tickets and pass types under retail.

|

| Figure 3: A demo of the new pass builder for the Google Wallet API. |

Get started with the Google Wallet API

Take a look at the documentation to start integrating Google Wallet today.

Learn more about the integration by taking a look at our sample source application in GitHub.

When you are ready, head over to the Google Pay & Wallet console and submit your integration for production access.

What’s next?

Shortly after Google I/O we announced 5 new ways to add more to Google Wallet. One of them is to save your ID to Google Wallet. And soon, you’ll be able to accept IDs from Google Wallet to securely and seamlessly verify a person's information. Some use cases include:

- Age Verification: Request age to verify before purchasing age-restricted items or access to age-restricted venues.

- Identity Verification: Request name to verify the person associated with an account.

- Driving Privileges: Verify a person's ability to drive (e.g. when renting a car).

If you’re interested in using Google Wallet's in-app verification APIs, please fill out this form.

5 new ways to add more to Google Wallet

Google Wallet introduces new features bringing even more convenience and security to accessing your everyday essentials.

Google Wallet introduces new features bringing even more convenience and security to accessing your everyday essentials.

Source: The Official Google Blog

5 new ways to add more to Google Wallet

Google Wallet introduces new features bringing even more convenience and security to accessing your everyday essentials.

Google Wallet introduces new features bringing even more convenience and security to accessing your everyday essentials.

Source: The Official Google Blog

What’s new in Google Pay

During Google I/O 2023, we shared some of the new features we’re adding to Google Pay and discussed how you can use them to simplify and strengthen your integrations, and add value to your customers making payments in your application or website.

Read on for a summary of what we covered during the event, or check out the recording of our session on YouTube: What's new in Google Pay and Google Wallet.

Liability shift on eligible transactions with Google Pay

Google Pay is expanding its zero fraud liability protection on Android devices for eligible transactions leveraging leading payment network security capabilities. Before today, online payments made with a Mastercard were guaranteed by this protection. Today, we are announcing that we are expanding this benefit by rolling out merchant liability protection to eligible Visa online transactions that are made using Google Pay.

In addition, we're making it easy to verify and add forms of payments to Google Pay. As just one example, Google Pay has added support for card authentication both before and after a payment transaction. Google Pay users are now able to verify their saved card via an OTP code or their banking app which creates a device-bound token that supports secure and seamless transactions both online and offline.

Reduce fraud with Google Pay

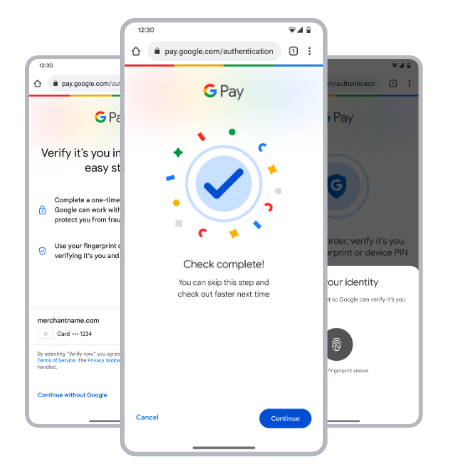

As part of our mission to help you reduce fraud and improve authorization rates without increasing user friction, we're actively working on a new service — Secure Payment Authentication, a service built to help with risk and compliance based authentication needs. This service can be used for eligible payment transactions that require additional verification, and use secure and high performing device bound tokens to meet two-factor authentication.

We are using this opportunity to engage with businesses like you as part of an early access program, to understand how it can help you boost authorization performance. If fraud is a challenge for your business today, contact us to tailor your authentication strategy with Secure Payment Authentication.

|

| Figure 1: Example authentication flow using Secure Payment Authentication. |

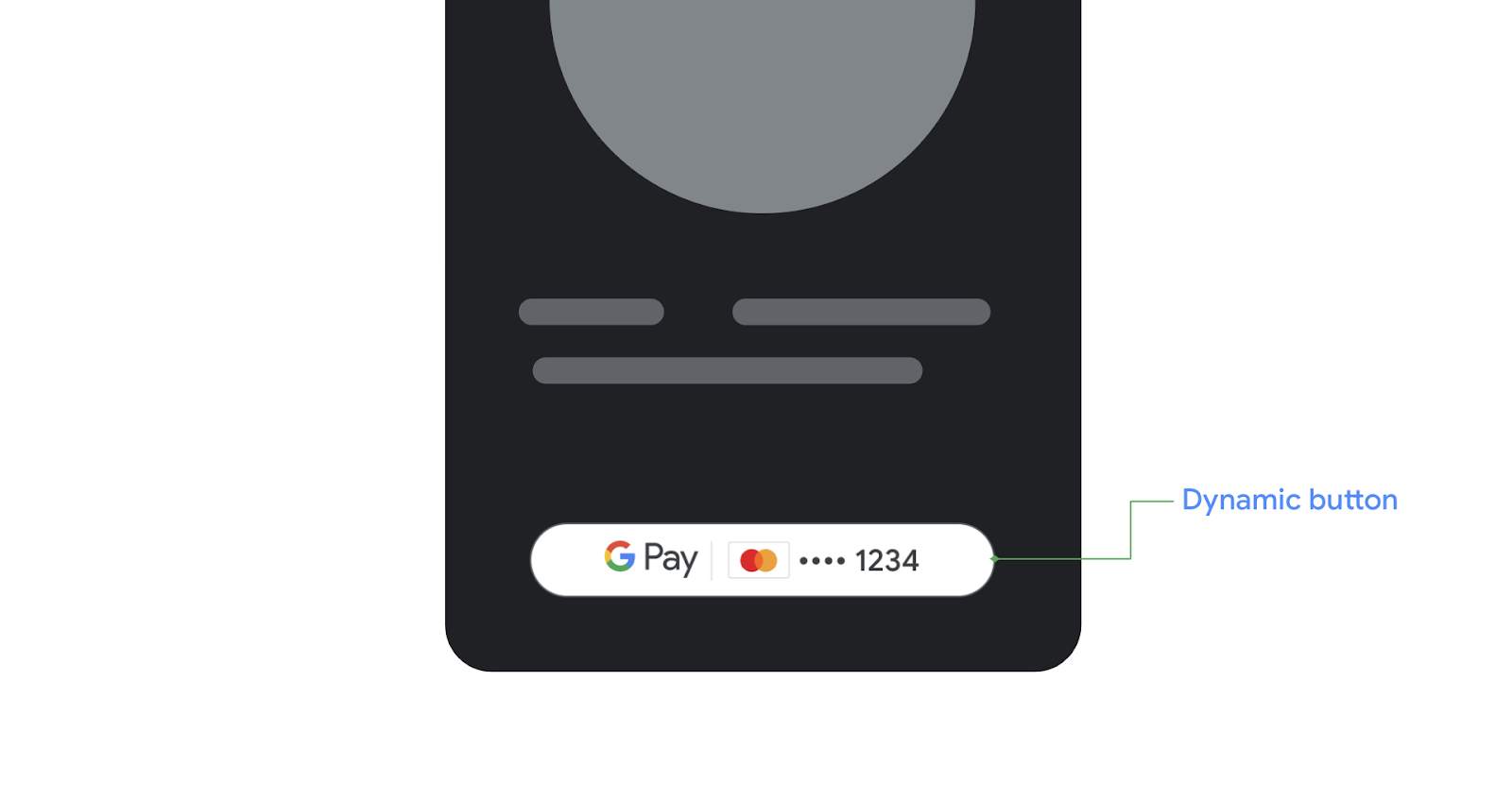

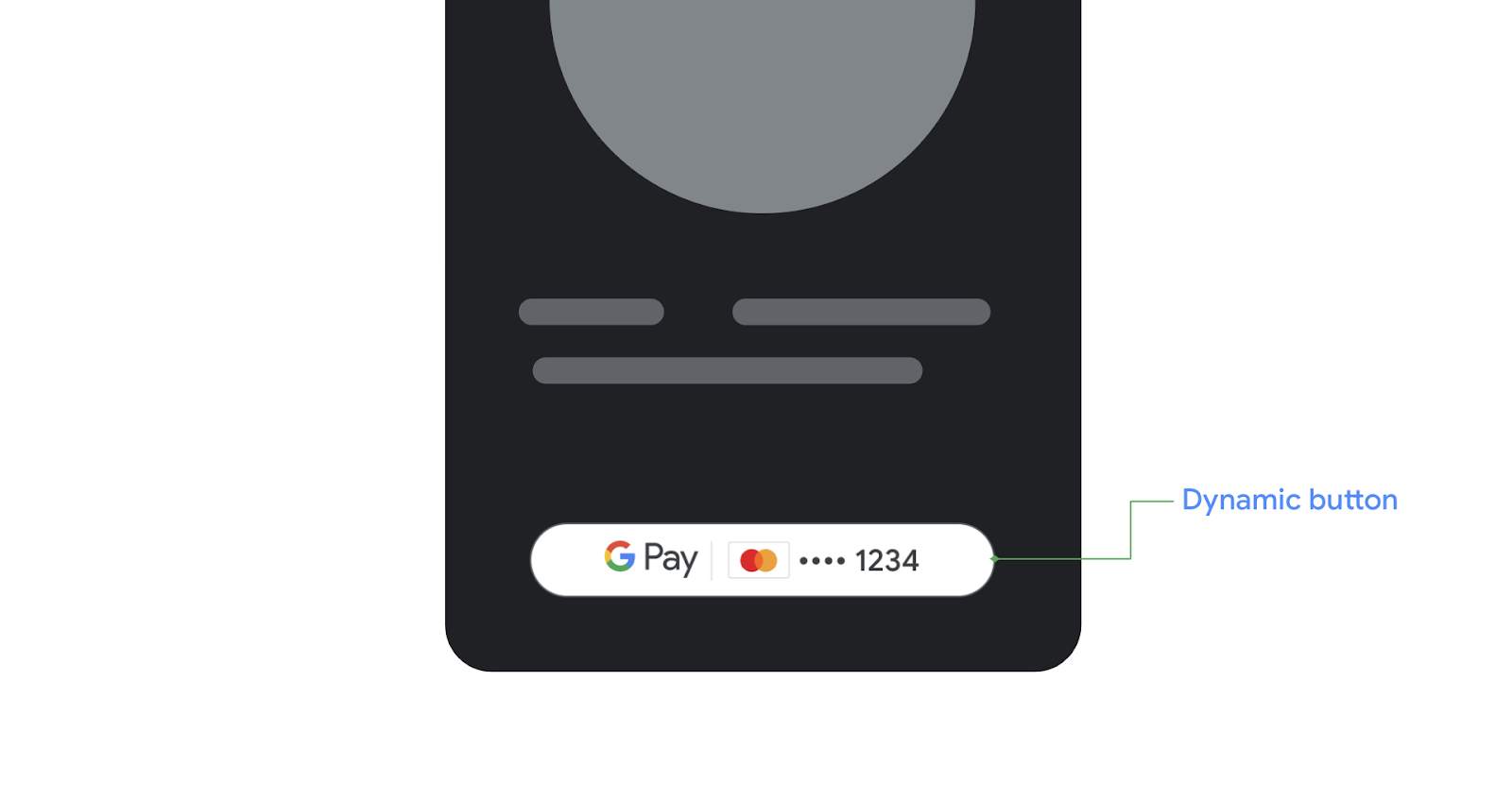

The new dynamic button

We are giving the Google Pay button a fresh new look, applying the latest Material 3 design principles. The new Google Pay button comes in two versions that make it look great on both dark and light themed applications.

|

| Figure 2: The new Google Pay button view for Android can be customized to make it more consistent with your checkout experience. |

We're also introducing a new button view that simplifies the integration on Android. This view lets you configure properties like the button theme and corner radius directly in your XML layout. The new button API is available today in beta. Check out the updated tutorial for Android to start using the new button view today.

Later this quarter, you’ll be able to configure the new button view for Android to show your users additional information about the last card they used to complete a payment with Google Pay.

|

| Figure 3: An example of how the dynamic version of the new Google Pay button view will look on Android. |

An improved test suite with payment service provider cards

We are introducing PSP test cards, an upgrade to Google Pay’s test suite that lets you use test cards from your favorite payment processors to build end-to-end test scenarios. With this upgrade, you’ll now see specific test cards from your processor populate in Google Pay’s payment sheet, enabling additional testing strategies, both manual and automated.

|

| Figure 4: Test cards from your payment processor appear in Google Pay’s payment sheet when using TEST mode. |

This upgrade also supports test automation, so you can write end-to-end UI tests using familiar tools like UIAutomator and Espresso on Android, and include them in your CI/CD flows to further strengthen your checkout experiences. The new generation of Google Pay’s test suite is currently in beta, with web support coming later this year.

Virtual cards, autofill and more

Last year we introduced virtual cards on Android and Chrome. Since then, we’ve seen great adoption, providing secure and frictionless online checkout experiences for millions of users. Customers using virtual cards have enjoyed faster checkouts, reported less fraudulent spend, and made online transactions that were declined less often.

Autofill is receiving visual improvements to reduce checkout friction, and will soon let your customers complete payment flows using bank accounts in Europe. For developers using autofill, we are introducing recommendations in Chrome DevTools to help you improve checkout performance. We are also improving autofill to better fill forms across frames, helping you facilitate payments more securely.

Check out the Google I/O keynote for Google Pay and Google Wallet to learn more.

What’s ahead

We are determined to grow the number of verified forms of payment across the Google ecosystem, and continue to push for simple, helpful, and secure online payments, offering you a way to empower other businesses, and accelerate that change for consumers.

Later this quarter, you’ll be able to configure the new button view in your Android applications, to show your users additional information about the last card they used to complete a payment with Google Pay. We are also working on bringing the same customization capabilities announced for Android to your websites later this year.

Get started with Google Pay

Take a look at the documentation to start integrating Google Pay today.

Learn more about the integration by taking a look at our sample source application in GitHub.

When you are ready, head over to the Google Pay & Wallet console and submit your integration for production access.

Jetpack Compose Buttons for Google Pay and Google Wallet

We recently released a new Google Pay button view on Android which brings a range of new features, such as the latest Material 3 design principles, dark and light themed versions, and other new customization capabilities.

|

| Figure 1: The new Google Pay button view for Android can be customized to make it more consistent with your checkout experience. |

Jetpack Compose Buttons

We've now made the new Google Pay button available to Jetpack Compose developers with a new open source library compose-pay-button. Jetpack Compose is Android’s modern toolkit for building user interfaces when using the Kotlin language, and with this new library you can implement the Google Pay button in your Android apps with even less code than before.

Let's look at a quick example. Here you can see a typical Jetpack Compose UI, with the Google Pay button added. The button accepts a Jetpack Compose modifier for customization, and supports a variety of labels, in this case "Book with Google Pay".

setContent {

Column() {

PayButton(

onClick = { println("Button clicked") },

allowedPaymentMethods = "<JSON serialized allowedPaymentMethods>",

modifier = Modifier.width(300.dp),

type = ButtonType.PAY_BOOK,

)

}

} |

Google Wallet

Lastly, we've also released a corresponding library for Google Wallet, compose-wallet-button. The library provides a similar API to the Google Pay button, but instead bundles the same button assets available on the Google Wallet developer site, including both regular and condensed versions.

|

| Figure 2: Both regular and condensed versions of the Google Wallet button are available in the new library. |

Ready to get started? Check out the GitHub repositories for both compose-pay-button and compose-wallet-button where you can learn more about the libraries and how to add them to your Android apps!

Jetpack Compose Buttons for Google Pay and Google Wallet

We recently released a new Google Pay button view on Android which brings a range of new features, such as the latest Material 3 design principles, dark and light themed versions, and other new customization capabilities.

|

| Figure 1: The new Google Pay button view for Android can be customized to make it more consistent with your checkout experience. |

Jetpack Compose Buttons

We've now made the new Google Pay button available to Jetpack Compose developers with a new open source library compose-pay-button. Jetpack Compose is Android’s modern toolkit for building user interfaces when using the Kotlin language, and with this new library you can implement the Google Pay button in your Android apps with even less code than before.

Let's look at a quick example. Here you can see a typical Jetpack Compose UI, with the Google Pay button added. The button accepts a Jetpack Compose modifier for customization, and supports a variety of labels, in this case "Book with Google Pay".

setContent {

Column() {

PayButton(

onClick = { println("Button clicked") },

allowedPaymentMethods = "<JSON serialized allowedPaymentMethods>",

modifier = Modifier.width(300.dp),

type = ButtonType.PAY_BOOK,

)

}

} |

Google Wallet

Lastly, we've also released a corresponding library for Google Wallet, compose-wallet-button. The library provides a similar API to the Google Pay button, but instead bundles the same button assets available on the Google Wallet developer site, including both regular and condensed versions.

|

| Figure 2: Both regular and condensed versions of the Google Wallet button are available in the new library. |

Ready to get started? Check out the GitHub repositories for both compose-pay-button and compose-wallet-button where you can learn more about the libraries and how to add them to your Android apps!

Posted by Dominik Mengelt – Developer Relations Engineer

Posted by Dominik Mengelt – Developer Relations Engineer

Posted by Jose Ugia – Developer Relations Engineer

Posted by Jose Ugia – Developer Relations Engineer

Posted by Jose Ugia – Developer Relations Engineer

Posted by Jose Ugia – Developer Relations Engineer

Posted by Stephen McDonald, Developer Programs Engineer

Posted by Stephen McDonald, Developer Programs Engineer