Editor’s note: This article is a condensed version of a speech Caesar gave at the G20 Finance Leaders Meeting in Japan on Saturday, June 8, 2019.

Let me introduce you to Vijay Babu. Vijay owns a small laundry shop in Bangalore, India. He can’t read or write, but he was eager to go digital to cater to smartphone savvy millennials.

Vijay Babu used Google Pay, formerly known as Tez in India, to help grow his business.

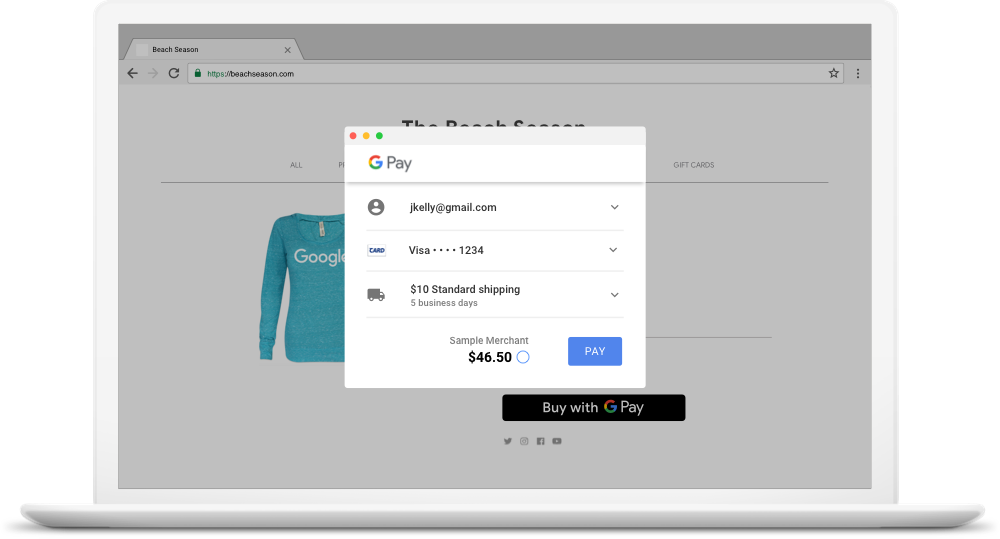

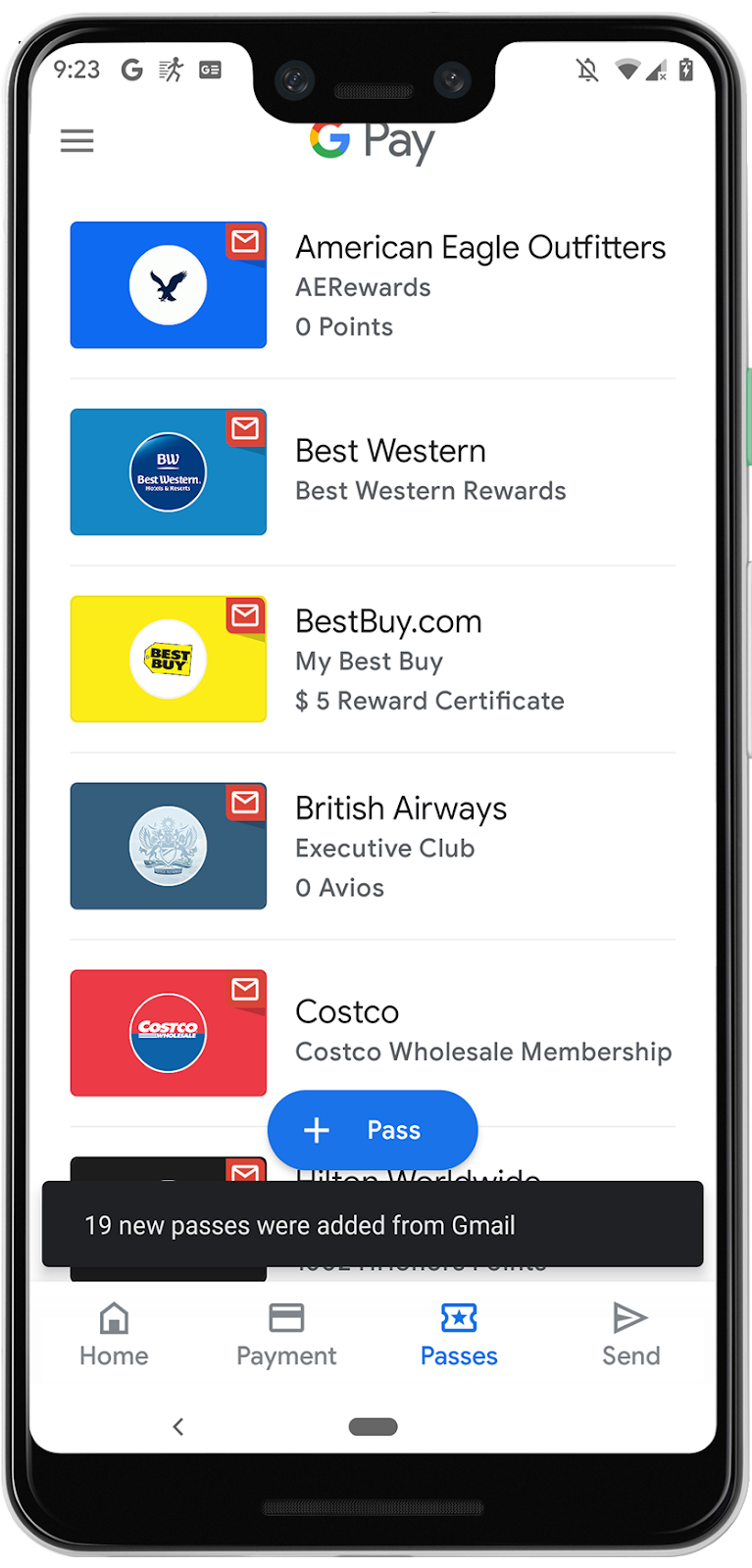

A year ago, he would have to pay $100 for a credit card terminal, deal with cumbersome printed receipts, and wait days to get paid. That’s no longer the case. Vijay Babu’s daughter helped him set up Google Pay on his Android smartphone. Today, he’s able to keep track of his transactions better, accept payments remotely and build relationships with his customers through Google Pay’s chat-based interface.

I believe technology is about solving the big problems, not just for a few, but for everyone.

That’s more possible today than ever before because of the smartphone. Smartphones are likely the first electronic device that all of humanity will possess. There are about four billion internet users in the world today, with another one billion coming online in the next few years. Almost all of them will be using smartphones. And here’s what’s amazing about the smartphone in your pocket: Today, it has more computing power and access to information than NASA had in 1969 when they put a man on the moon.

One of the biggest opportunities in front of us is how we apply that technology to the world of money. Whether you are an individual, a business or a country, your ability to access modern financial systems is pivotal to your success.

Unfortunately, in today’s smartphone-enabled, always connected world, payments don’t work for everyone. Younger demographics find banking experiences too antiquated. A recent study showed that 48 percent of millennials in the U.S, are considering moving to a digital only bank, and one in three millennials plan to switch banks in the next 90 days.

On the other hand, there are 2.5 billion adults in the world who are unbanked or underbanked—and the majority of them are women. This lack of access has huge implications for families, children, commerce and society at large. Besides consumers, payment challenges have an outsized impact on small businesses, the backbone of every economy.

We need to use technology and deploy it at scale to solve these hard and real problems. Doing so will help move countries from cash to digital, accelerate economic growth, and drive financial inclusion in economies.

At Google, building for everyone is a core philosophy. We know that we do better when everyone is invited in. Because Android is open source, there are 2.5 billion active Android devices today, made by over 1,300 different companies. And because Android is an open ecosystem, there are more than one million apps on the Google Play store.

It took a global community to put smartphones in everyone’s hands. Today, it’s time for that global community to come together again to digitize economies.

Caesar Sengupta speaking at the G20 Finance Leaders Meeting in Japan about how tech, governments and banks serve people better when they work together.

There's a popular but deeply mistaken belief that companies and banks are rivals that are working against each other. We believe that when tech and banks work together as partners, they're better able to help people.

For Google, partnering with banks helps us build products that work for everyone. By using our global infrastructure and technology platform to connect more customers to a formal financial system, we can support governments as they move societies from cash to digital and transform economies.

Four years ago, Prime Minister Narendra Modi called for a Digital India. We supported the Indian government and financial institutions in realizing their vision for payments. With Google tech and our knowledge of user experience, we created a simple payments app to work on the Unified Payments Interface (UPI), India’s real-time payments ecosystem. Since the launch of Google Pay in India (formerly known as Tez), transactions on UPI have increased 43 times, reaching 734 million transactions in May. Now, the cumulative value has overtaken that of credit and debit cards in India.

Google Pay has grown together with the rest of the digital payments ecosystem in India. Now, two out of every three transactions on Google Pay in India take place outside of India’s top six cities in more than 300,000 towns and villages across India made by millions of people like Vijay every day.

Stories like Vijay’s are examples of what is possible when governments, finance and tech work together. Together, we can and absolutely must empower billions more.

Posted by Jose Ugia, Developer Programs Engineer

Posted by Jose Ugia, Developer Programs Engineer