Cybercriminals continue to invest in advanced financial fraud scams, costing consumers more than $1 trillion in losses. According to the 2023 Global State of Scams Report by the Global Anti-Scam Alliance, 78 percent of mobile users surveyed experienced at least one scam in the last year. Of those surveyed, 45 percent said they’re experiencing more scams in the last 12 months.

The Global Scam Report also found that phone calls are the top method to initiate a scam. Scammers frequently employ social engineering tactics to deceive mobile users.

The key place these scammers want individuals to take action are in the tools that give access to their money. This means financial services are frequently targeted. As cybercriminals push forward with more scams, and their reach extends globally, it’s important to innovate in the response.

One such innovator is Monzo, who have been able to tackle scam calls through a unique impersonation detection feature in their app.

Monzo’s Innovative Approach

Founded in 2015, Monzo is the largest digital bank in the UK with presence in the US as well. Their mission is to make money work for everyone with an ambition to become the one app customers turn to to manage their entire financial lives.

Impersonation fraud is an issue that the entire industry is grappling with and Monzo decided to take action and introduce an industry-first tool. An impersonation scam is a very common social engineering tactic when a criminal pretends to be someone else so they can encourage you to send them money. These scams often involve using urgent pretenses that involve a risk to a user’s finances or an opportunity for quick wealth. With this pressure, fraudsters convince users to disable security safeguards and ignore proactive warnings for potential malware, scams, and phishing.

Call Status Feature

Android offers multiple layers of spam and phishing protection for users including call ID and spam protection in the Phone by Google app. Monzo’s team wanted to enhance that protection by leveraging their in-house telephone systems. By integrating with their mobile application infrastructure they could help their customers confirm in real time when they’re actually talking to a member of Monzo’s customer support team in a privacy preserving way.

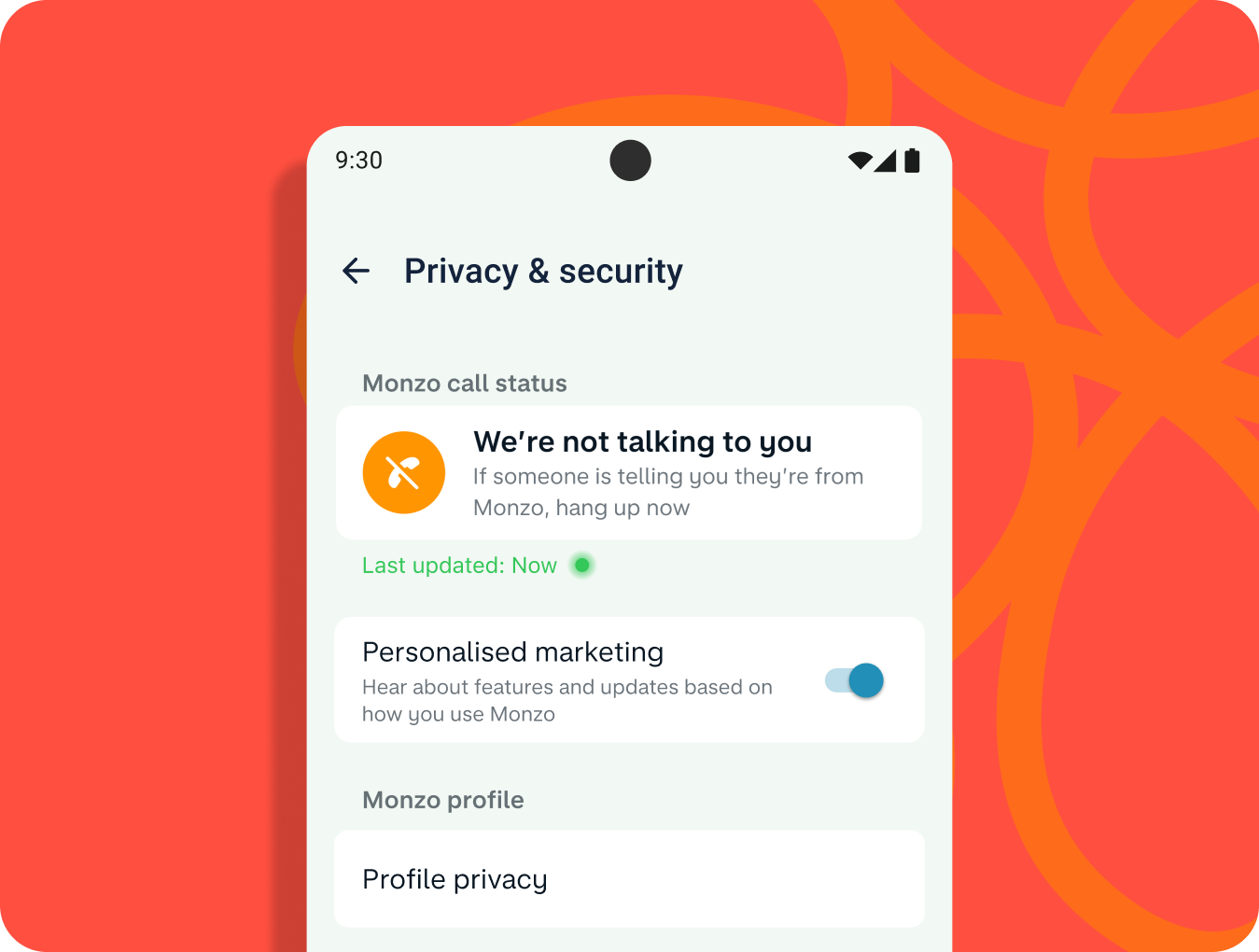

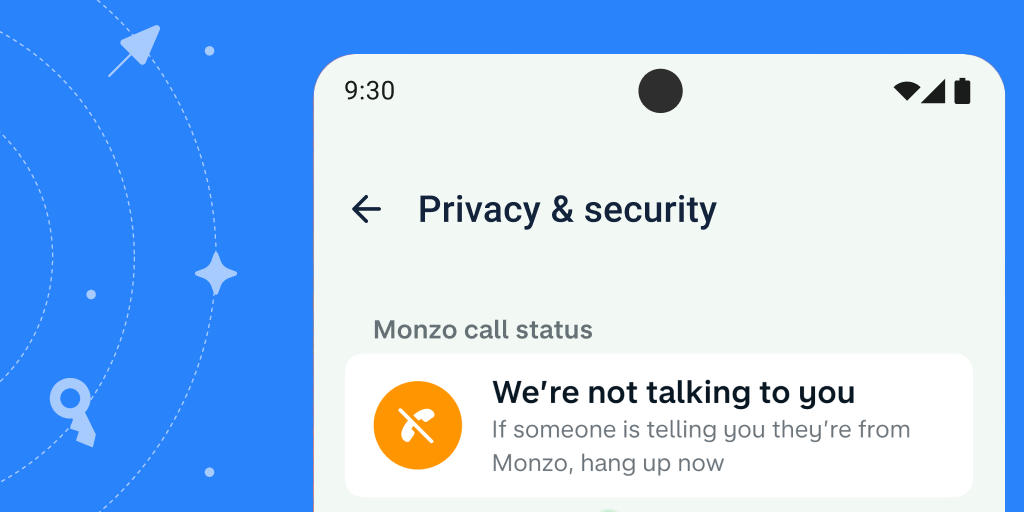

If someone calls a Monzo customer stating they are from the bank, their users can go into the app to verify this. In the Monzo app’s Privacy & Security section, users can see the ‘Monzo Call Status’, letting them know if there is an active call ongoing with an actual Monzo team member.

“We’ve built this industry-first feature using our world-class tech to provide an additional layer of comfort and security. Our hope is that this could stop instances of impersonation scams for Monzo customers from happening in the first place and impacting customers.”- Priyesh Patel, Senior Staff Engineer, Monzo’s Security team

Keeping Customers Informed

If a user is not talking to a member of Monzo’s customer support team they will see that as well as some helpful information. If the ‘Monzo call status’ is showing that you are not speaking to Monzo, the call status feature tells you to hang up right away and report it to their team. Their customers can start a scam report directly from the call status feature in the app.

If a genuine call is ongoing the customer will see the information.

How does it work?

Monzo has integrated a few systems together to help inform their customers. A cross functional team was put together to build a solution.

Monzo’s in-house technology stack meant that the systems that power their app and customer service phone calls can easily communicate with one another. This allowed them to link the two and share details of customer service calls with their app, accurately and in real-time.

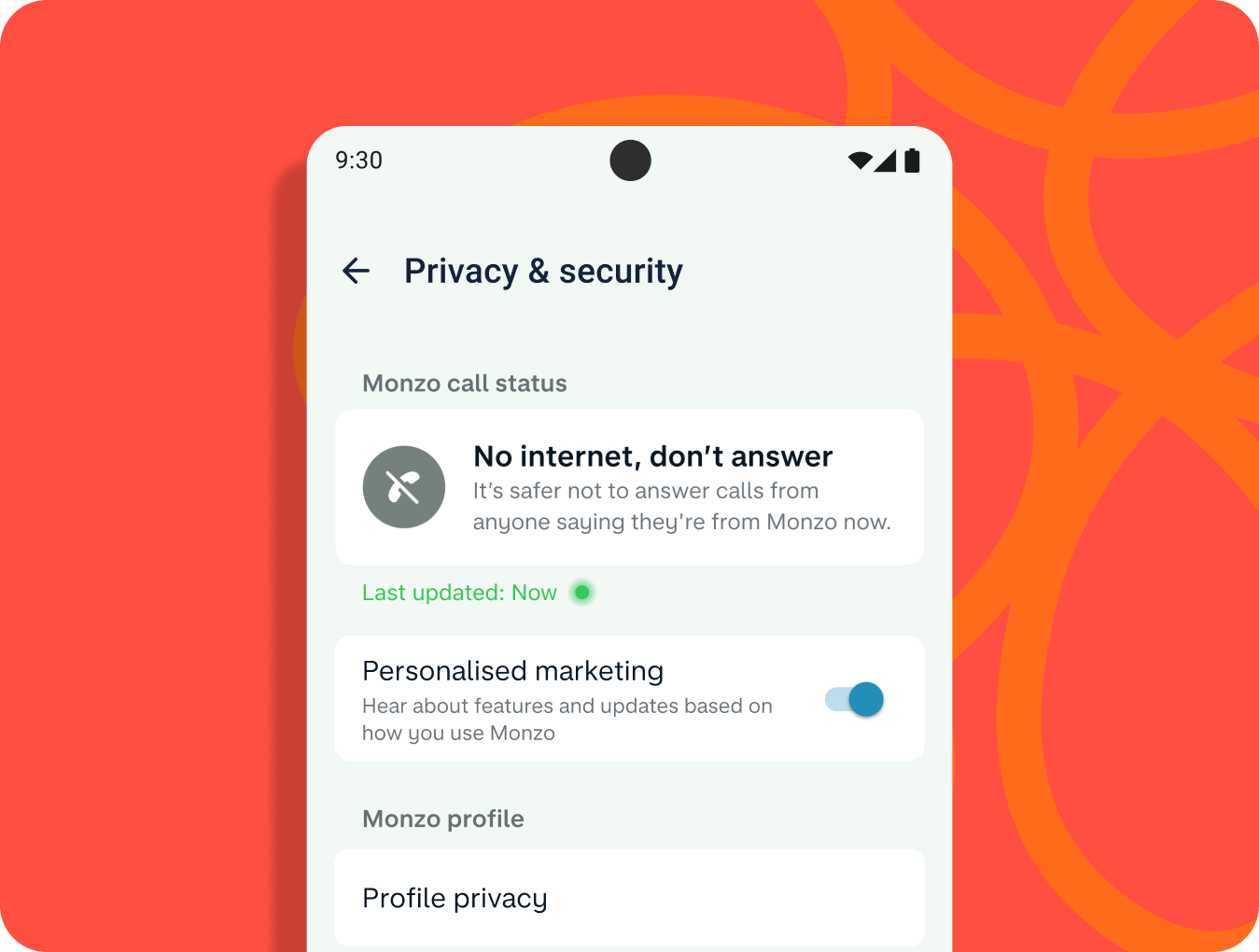

The team then worked to identify edge cases, like when the user is offline. In this situation Monzo recommends that customers don’t speak to anyone claiming they’re from Monzo until you’re connected to the internet again and can check the call status within the app.

Results and Next Steps

The feature has proven highly effective in safeguarding customers, and received universal praise from industry experts and consumer champions.

“Since we launched Call Status, we receive an average of around 700 reports of suspected fraud from our customers through the feature per month. Now that it’s live and helping protect customers, we’re always looking for ways to improve Call Status - like making it more visible and easier to find if you’re on a call and you want to quickly check that who you’re speaking to is who they say they are.”- Priyesh Patel, Senior Staff Engineer, Monzo’s Security team

Final Advice

Monzo continues to invest and innovate in fraud prevention. The call status feature brings together both technological innovation and customer education to achieve its success, and gives their customers a way to catch scammers in action.

A layered security approach is a great way to protect users. Android and Google Play provide layers like app sandboxing, Google Play Protect, and privacy preserving permissions, and Monzo has built an additional one in a privacy-preserving way.

To learn more about Android and Play’s protections and to further protect your app check out these resources:

Posted by Todd Burner – Developer Relations Engineer

Posted by Todd Burner – Developer Relations Engineer