Posted by Jose Ugia and Checkout.com

We sat down with Riaz Bordie, the CTO of Checkout.com, a leading international provider of online payment solutions, to get his advice to merchants and the developer community on how to think about future-proofing payments in the uncertain world we live in today.

Jose Ugia: What advice do you have for merchants and developers as it relates to payments in these difficult times?

Riaz: Merchants are seeing a polarizing impact of COVID-19 on their businesses. For those who have an online presence, you’re either seeing a lull in traffic or a spike.

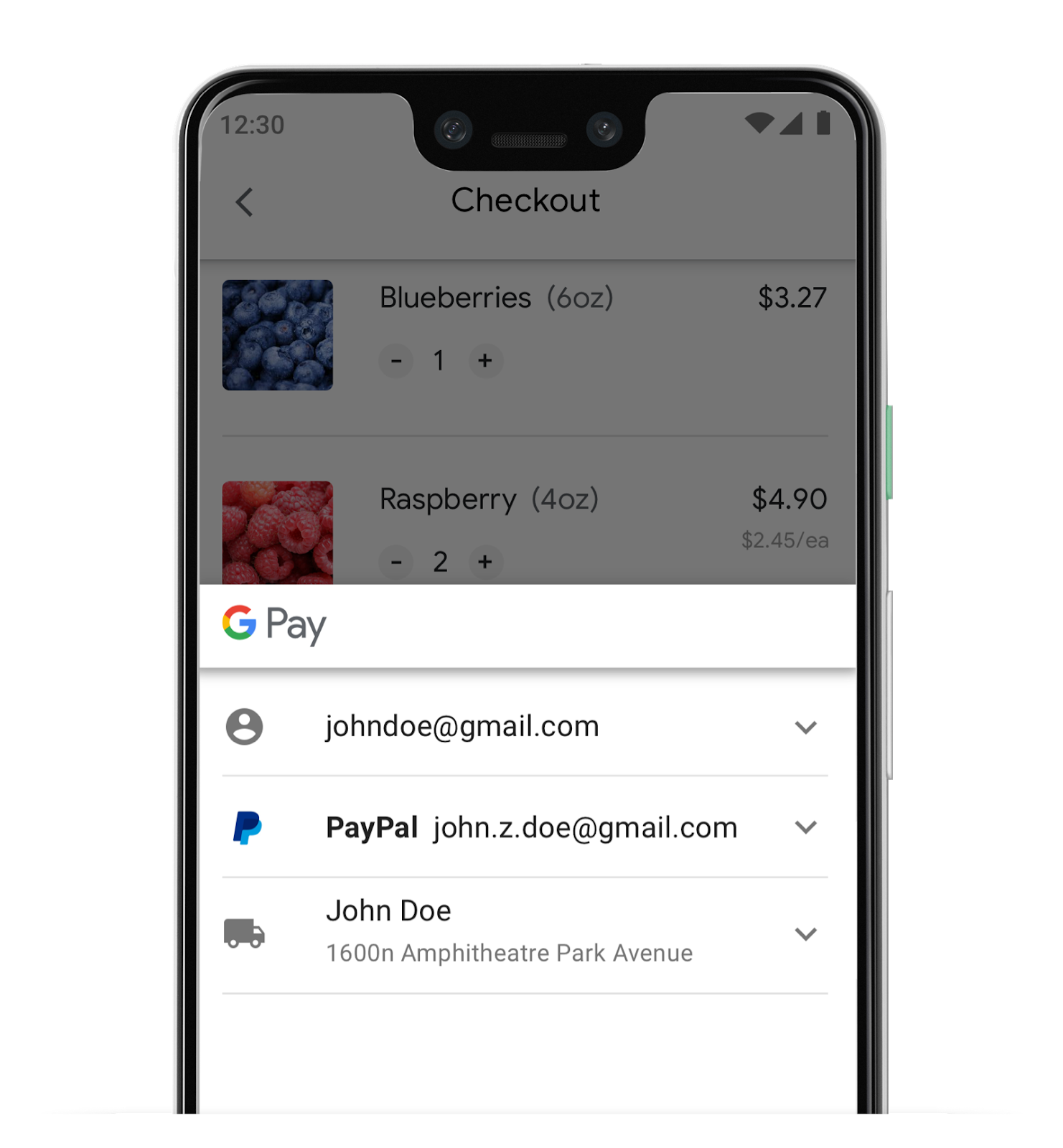

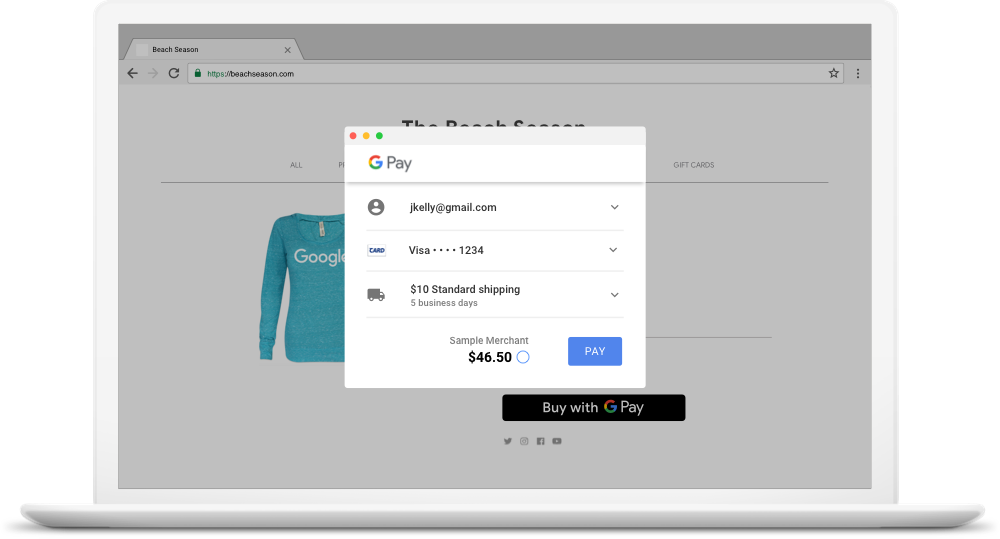

If you’re a merchant who’s seeing traffic dwindle, it’s more important than ever to make sure every transaction counts. If you used to see 50 transactions a day and now you see 10, you want to make sure all 10 deliver. Work with your Payment Service Provider (PSP) to make sure your approval ratios are as optimal as possible -- a legitimate customer who gets declined incorrectly may not return to purchase as they have in the past. If your PSP supports alternative payment methods like Google Pay that decrease friction at checkout and local payment methods if you’re selling internationally, that’s ideal. Keep an eye on your PSP’s stacks and uptimes to make sure you’re not missing out on sales due to outages or technical issues.

If you’re a merchant seeing a spike in traffic, that’s great news! But it’s important to note that a sudden traffic increase without proper operational and infrastructure planning can lead to fraud spikes, decreases in approval ratios, and downtime. With higher sales velocity, risk related issues will multiply. You’ll see more attempted fraud as fraudsters take advantage of unsuspecting consumers, higher payment declines resulting from outdated issuer risk modeling and excessive chargeback levels, subscription cancellations, buyer’s remorse, among others. How are your payments infrastructure and operations equipped to handle all of this?

Make sure your infrastructure is capable of scaling up. If you don’t have autoscaling, you’ll need a team and processes in place to scale infrastructure for traffic spikes, and keep in mind this may get harder with people working remotely. Work your PSP and other providers to optimize your payments, risk models and chargeback handling during this challenging time.

For both types of merchants, it’s important to pay closer attention to performance of your payments system. This includes both ensuring that processes are working in an optimal way - especially given remote working situations and also ensuring that you are seeing efficiencies at scale.

Jose Ugia: How did you think about building a payments infrastructure that was scalable and future-proof at Checkout.com?

We knew in the beginning we wanted a unified API, which through a single integration gives a merchant access to any market via a range of payment methods and other facilities. We’ve worked hard to get acquiring licenses in as many markets as possible so we can bring acquiring in-house, which in turn gives us greater visibility on the entire payment flow. We have also invested in a gateway that can be consistently deployed in local geographies so that whether the merchant is in Dubai or Singapore, they are getting the most optimal traffic flow.

Any engineer knows that tech breaks. Those who win have a better plan for dealing with breakage efficiently, to consistently maintain high levels of service. We spend a lot of time and resources on making sure our stack is resilient and we have the right operational processes in place to both proactively monitor for potential issues and respond correctly when they come up.

Jose Ugia: Speaking of where things are headed, where do you see the future of payments going from a payment service provider perspective?

A few key trends I see:

Risk & Fraud Detection. AI/ML is improving every aspect of tech. Fraudsters will get smarter but so will fraud prevention - it’s a cat and mouse game. In payments, sophisticated risk engines offering ML-based transaction scoring and highly customizable rules builders, among other features, will get better at detecting fraud without compromising sales.

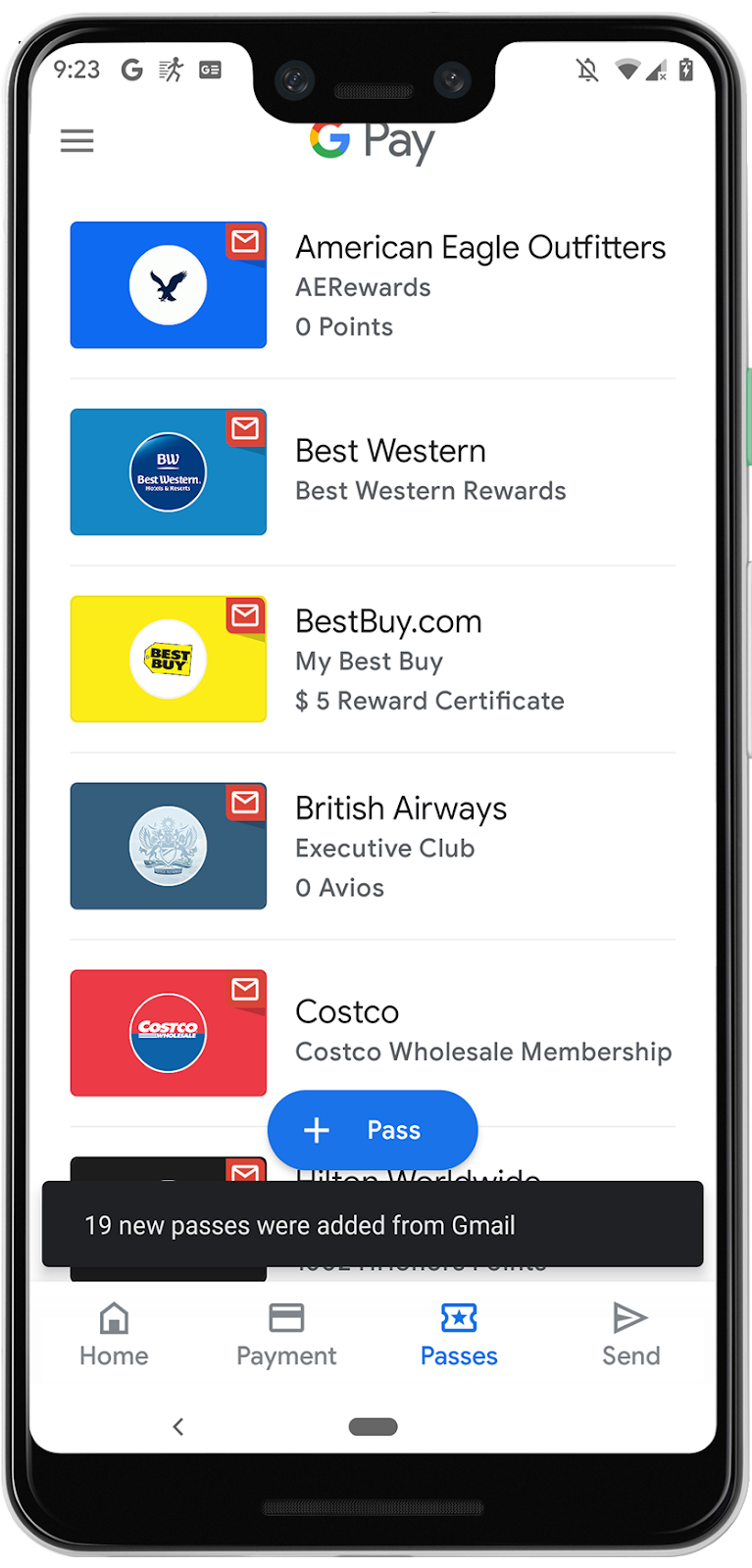

Global acceptance will continue to be complex but paramount. Offering a variety of payment methods is table stakes these days. More and more, we’ll see that local payment methods aren’t the alternative but instead the primary way consumers pay. For example, you need to have Giropay if you’re selling in Germany and Alipay if you’re selling in China if you want a high conversion rate. Ensure that you and your local entities have an optimized setup with your acquirer (ideally domestic where possible) focused on achieving the lowest costs and highest approval rates.

Embedded infrastructure. Merchants - especially enterprise players - will want increased visibility and more control on optimizing their payment systems. We offer this level of insight and flexibility to our merchants today via our APIs around risk, reconciliation, disputes, etc. But we’re headed toward a world where dedicated infrastructure will become part of the package and allow for complete data separation and zero contention.

Jose Ugia: How do you think these changes of payments infrastructure will impact consumers downstream?

Convenience is king among consumers. I believe that COVID-19 will accelerate the move toward a contactless payments society, with consumers relying more on digital wallets and opportunities to pay through their devices. I personally no longer take my wallet out with me when I leave the house. A couple of years ago that felt like a conscious decision - now it’s just part of everyday life to rely solely on my smartphone to pay.

In some regions like MENA, which has typically been a cash-on-delivery society, we’re seeing more merchants close off cash and impose digital payments, opening up more adoption of upfront e-commerce payments. As mandated payment methods begin to change consumer behavior (studies say it takes 2 months to change a habit), new ways of paying will be here to stay, even beyond COVID-19.

Interested in learning more about Checkout.com’s services or speaking to a payments expert on how to optimize your payments stack? Contact us here. For Google Pay related requests and questions or to start your Google Pay integration, visit the Google Pay Business Console.

Posted by Jose Ugia, Google Developers Engineer

Posted by Jose Ugia, Google Developers Engineer

Posted by Jose Ugia, Developer Programs Engineer

Posted by Jose Ugia, Developer Programs Engineer