Posted by David Ko, Engineering Director; Jeff Lim, Software Engineer; Pankaj Gupta, Director of Engineering; Will Horn, Software Engineer

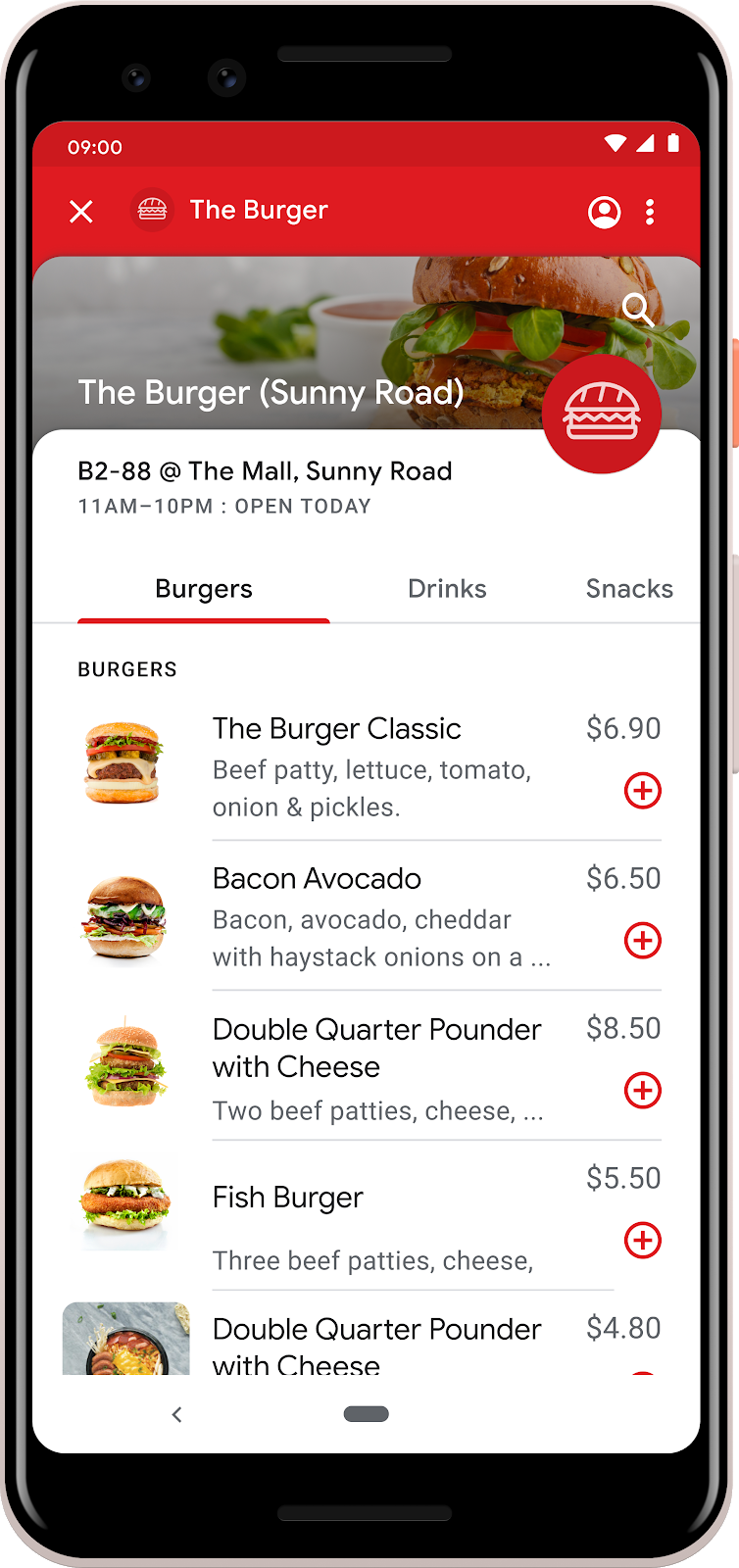

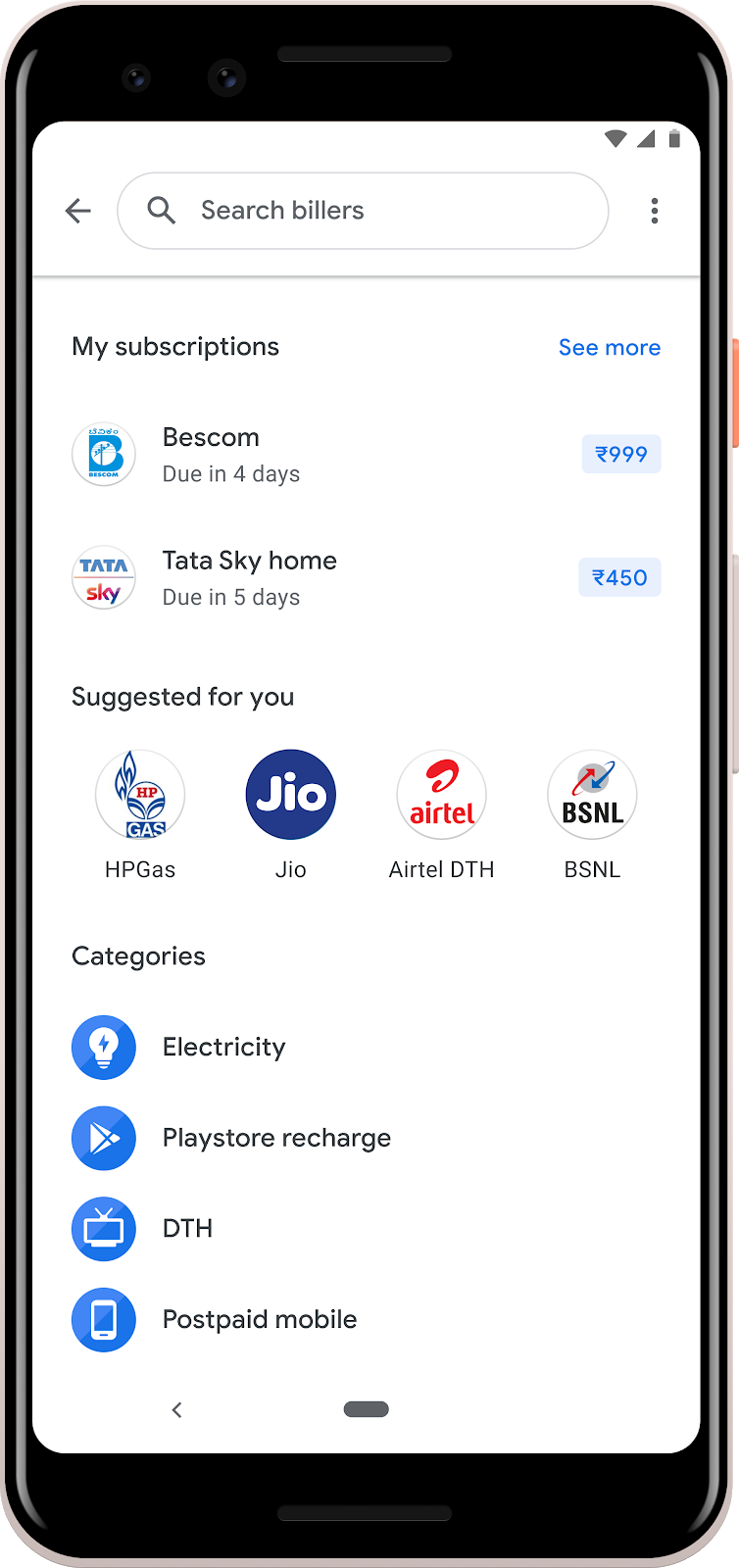

Three years ago, when we launched Google Pay India (then called Tez), our vision was to create a simple and secure payment app for everyone in India. We started with the premise of making payments simple and built a user interface that made making payments as easy as starting a conversation. The simplicity of the design resonated with users instantly and over time, we have added functionality to help users do more than just make payments. Today users can pay their bills, recharge their phones, get loans instantly through banks, buy train tickets and much more all within the app. Last year, we also launched the Spot Platform in India, which allows merchants to create branded experiences within the Google Pay app so they can connect with their customers in a more engaging way.

As we looked at scaling our learnings from India to other parts of the world, we wanted to focus on a fast and efficient development environment, which was modern and engaging with the flexibility needed to keep the UI clean. And more importantly one that enabled us to write once and be able to deploy to both iOS and Android reaching the wide variety of users.

It was clear that we would need to build it, and ensure that it worked across a wide variety of payment rails, infrastructure, and operating systems. But with the momentum we had for Google Pay in India, and the fast evolving product features - we had limited engineering resources to put behind this effort.

After evaluating various options, it was easy to pick Flutter as the obvious choice. The three things that made it click for us were:

- We could write once in Dart and deploy on both iOS and Android, which led to a uniform best-in-class experience on both Android and iOS;

- Just-in-Time compiler with hot reload during development enabled rapid iteration on UI which tremendously increased developer efficiency; and

- Ahead-of-time compilation ensured high performance deployment.

Now the task was to get it done. We started with a small team of three software engineers from both Android and iOS. Those days were focused and intense. To start with we created a vertical slice of the app — home page, chat, and payments (with the critical native plugins for payments in India). The team first tried a hybrid approach, and then decided to do a clean rewrite as it was not scalable.

We ran a few small sprints for other engineers on the team to give them an opportunity to rewrite something in Flutter and provide feedback. Everyone loved Flutter — you could see the thrill on people’s faces as they talked about how fast it was to build a user interface. One of the most exciting things was that the team could get instant feedback while developing. We could also leverage the high quality widgets that Flutter provided to make development easier.

After carefully weighing the risks and our case for migration, we decided to go all in with Flutter. It was a monumental rewrite of a moving target, and the existing app continues to evolve while we were rewriting features. After many months of hard work, Google Pay Flutter implementation is now available in open beta in India and Singapore. Our users in India and Singapore can visit the Google Play Store page for Google Pay to opt into the beta program and experience the latest app built on Flutter. Next, we are looking forward to launching Google Pay on Flutter to everyone across the world on iOS and Android.

We hope this gives you a fair idea of how to approach and launch a complete rewrite of an active app that is used by millions of users and businesses of all sizes. It would not have been possible for us to deliver this without Flutter’s continued advances on the platform. Huge thanks to the Flutter team, as today, we are standing on their shoulders!

When fully migrated, Google Pay will be one of the largest production deployments on the Flutter platform. We look forward to sharing more learnings from our transition to Flutter in the future.